FST BLOG

How We Can Use Advanced Materials to Make the UK a Key Link in the Global Semiconductor Supply Chain

- 11 April 2025

- Business, Technology

- John Tingay

With complex supply chains that take materials and modules backwards and forwards across international borders before a saleable product is created, the logistics of how products reliably get to consumers is of underappreciated importance. Even for basic, everyday products, prices and availability are not only dependent on the collection, manufacturing and transportation involved in bringing them to consumers. Concerns about the politics, environment and economies of faraway places have real consequences for what winds up in our shopping baskets and the packages that arrive on our doorstep.

Global supply chains are growing more complex and more fraught, and evidence for that trend is particularly acute in the case of semiconductors. The tiny ‘chips’ that load so much information and functionality into miniscule packages also encapsulate a world of material, economic and political concerns.

Silicon, the material at the heart of the vast majority of semiconductor devices, is one of the most-abundant elements on earth, but the type of silicon required for the construction of chips comes from a kind of high-purity quartz that can only be sourced from a select group of sites. Eighty-to-ninety percent of this quartz emerges from a quarry in the rural, Blue Ridge hamlet of Spruce Pine, North Carolina. Once that quartz winds its way through the narrow mountain roads leading out of Spruce Pine, most of it finds its way to Taiwan, a small island nation literally on the other side of the world. It is on this island where 65 percent of world’s semiconductor devices are constructed at Taiwan Semiconductor Manufacturing Company’s (TSMC) massive foundry, including a higher percentage of the devices needed for AI.

The machinery TSMC relies on to churn out the most advanced of those chips comes entirely from one distantly located company: ASML, in Veldhoven, Netherlands. ASML accounts for a healthy 30 percent of all semiconductor equipment; however, their lithography machines account for 95 percent of the global market and that rises to a full 100 percent of extreme ultraviolet (EUV) lithography machines, which are necessary for the most-advanced chips.

The existence of these nodes through which so much of the semiconductor supply chain is routed has its efficiencies. Still, it also highlights the fragility of the supply chain and raises concerns about how we guard against political, environmental and economic shocks – shocks that have recently proven not-at-all hypothetical – depriving the rest of the world of these vital devices.

Last September, Hurricane Helene ripped through Spruce Pine and its neighbouring communities in Western North Carolina. Homes, businesses and vital infrastructure in the region have been destroyed, putting the availability of Spruce Pine’s quartz in peril for the near future. On a geopolitical level, the potential weakening of multinational economic and military alliances (e.g., the European Union, NATO, AUKUS, etc.), budding trade wars and the existence of bellicose regional powers threaten the relative seamlessness of global trade that much of the world had come to regard as the accepted norm.

Even disregarding the threats to the future of these particular nodes, volatile energy markets, hostile actors near transportation choke points and mishaps like the Ever Given getting stuck in the Suez Canal make the prospect of moving the raw materials, machinery and end products around the globe to satisfy the semiconductor market a fraught endeavour.

The solution, of course, is not to attempt bringing this supply chain entirely onto British shores as a means of ensuring the UK’s access to vital technology. The structure of the conventional semiconductor supply chain is firmly established and we do not have the resources to reconstruct it here. There is, however, an opportunity for the UK to establish a substantial foothold in future supply chains by investing in advanced materials.

While silicon-based semiconductors are not going away anytime soon, we are approaching the limits of speed and energy performance that silicon provides. Future semiconductor devices are being developed with a range of materials that can better deal with the demands of data centres, AI, quantum computing and electric vehicles, all building on the investment made in silicon manufacturing.

There is already a race on to create a supply chain around materials such as gallium and germanium, with China leveraging its reserves through export controls. The US, EU, Japan and South Korea are investing in domestic refining capabilities and alternative semiconductor supply chains to reduce reliance on Chinese processing and to exploit their own reserves of these critical materials. For years Western nations have outsourced the environmentally challenging extraction and refining of many materials.

With the announcement of plans for a new Critical Minerals Strategy (CMS), the UK government has signalled a determination to join this race. The CMS will be designed to address how the UK can secure critical minerals from its allies and navigate restrictions from other sources. While that is a worthy aim, policymakers should also consider another recently released strategy: the National Materials Innovation Strategy, published by the Henry Royce Institute.

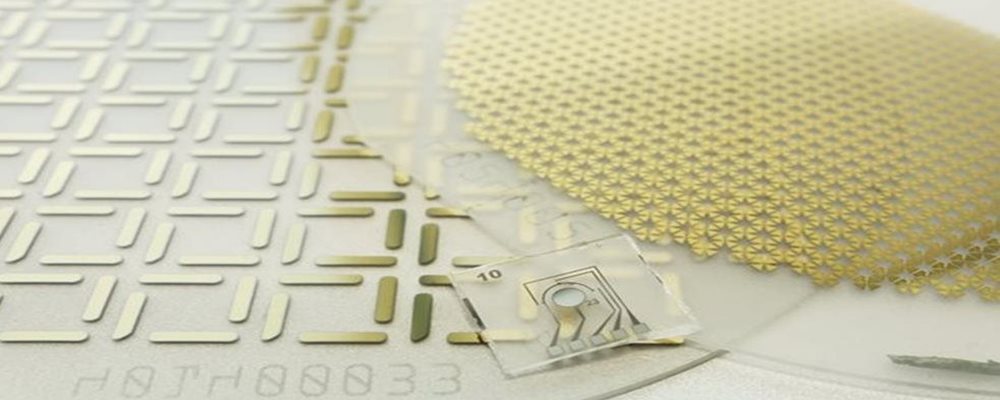

This strategy presents a comprehensive plan to leverage the UK’s expertise in materials science to drive economic growth and address critical challenges such as sustainability, energy efficiency and healthcare. It highlights the UK’s leadership in two-dimensional (2D) materials, particularly graphene. Following the Nobel Prize-winning isolation of graphene at the University of Manchester, another UK-based entity – Cambridgeshire-based Paragraf – has become the first company in the world to use the material to produce electronic devices such as magnetic and molecular sensors, as well as developing chips for quantum computing, electric vehicles, energy storage and chemical testing.

Paragraf has earned grants through Innovate UK to develop graphene on six-inch wafers, which will supercharge production capacity, and to create graphene-based memory devices, which will be key to creating solutions for AI-compatible data centres.

Graphene is a single layer of carbon atoms. Carbon, of course, is ubiquitous; however, the critical IP for creating mass-producible electronic devices with this particular carbon allotrope is exclusive to this particular British company. For the moment, the UK stands to serve as the Spruce Pine and the Taiwan of the graphene electronics revolution. Aligned with the country’s world-leading educational institutions and history of global trade, this means that the UK can assume a vital role in the supply chain of next-generation semiconductor devices.

The Henry Royce Institute’s strategy emphasises the UK’s commitment to accelerating the commercialisation of research outcomes and fostering an environment conducive to business growth while ensuring that companies maintain control over their proprietary technologies.

The strategy recognises the crucial role of materials innovation in driving economic growth and competitiveness, stating that it "pervades almost every technological challenge facing society." To this end, it aims to "stimulate innovation, applications, and market opportunity in the UK and overseas, aligned to societal, environmental, and economic goals."

The recognition of the government and public service organisations of the opportunity provided by advanced materials to guide the future of semiconductors is an encouraging development. To truly future-proof its technology sector, the UK must also build on its world-class research in materials innovation, ensuring that scientific breakthroughs translate into economic opportunity. By combining supply chain security with pioneering advancements in graphene and other 2D materials, the UK can establish itself as a global leader in the industries of the future, and it can do so in a manner that serves to ease the volatility surrounding these important supply chains.

John Tingay has served as Chief Technology Officer at Paragraf since 2020. John has worked in the semiconductor industry, in a variety of executive roles since the 1990s. He also serves as an Advisory Board Member at the UK Innovation & Science Seed Fund and is a Fellow of the Institution of Mechanical Engineers.